Author's Posts

.avif)

Business without chaos: 5 simple steps to growth

No matter what stage your business is at now, these 5 steps can be the start of a new quality of management.

In business, there’s no such thing as a perfect moment for change. But there are the right decisions — and they’re what separates those who grow from those who stay stuck.

Want this year to be a real breakthrough for your business? Then don’t wait for the perfect moment — act now.

This article gives you 5 proven steps to bring order, increase efficiency, and make a leap forward — without burnout or chaos.

1. Lay a Solid Foundation for a New Strategy

Before setting new goals, analyze what worked before. What parts of the previous plan were successfully implemented? What results actually impacted your business? And where were the losses, mistakes, or just illusions?

To do this properly — summarize the year: financially, operationally, strategically. We’ve put together a step-by-step guide on how to prepare and analyze reports — with examples and a detailed video.

Next step — involve your team. Run a brainstorming session: let everyone share their vision, problems, and ideas. This isn’t just “gathering opinions” — it’s a chance to see the business from different angles and get your people engaged in the shared result.

Don’t hold back on creativity — sometimes an unconventional idea becomes a breakthrough. The outcome will be an updated business plan based on data and your team’s real experience.

2. Free Your Business from Routine — Automate Processes

Daily repetitive tasks drain not just time, but energy. As a result, your team works on the edge while strategic goals keep getting postponed. Sound familiar?

Automation helps you regain control. What used to take hours can now be handled in a few clicks — or without your involvement at all. For example:

- Do clients often ask the same questions? Set up an AI bot.

- Struggling with complex payment and expense tracking? Enable automatic imports and reporting.

- Sending the same invoices every month? Turn on auto-generated invoicing.

Repetitive tasks are the first thing to delegate to a system.

This not only saves you time, but reduces the risk of errors. Most importantly, it creates space for business growth.

3. Make Marketing an Asset, Not an Expense

What worked a year ago might not deliver results today. Marketing changes faster than you can update your banners. That’s why it’s essential not to get stuck in the past — test new approaches, experiment, and stay alert.

Here are a few directions worth considering right now:

- AI in Action

Chatbots? Sure. But not just that. AI helps write content, tailor ads to user behavior, and even predict what will work. The sooner you adopt it — the bigger your advantage. - Interactivity is the New Standard

Simple videos aren’t enough anymore. Engage your customer: quizzes, polls, calculators, gamification. This isn’t entertainment — it’s experience-driven selling. - Being Honest = Being Strong

Brands that speak about their values attract people. Supporting volunteers, planting trees, helping the Armed Forces? Don’t stay silent. Just make sure your actions are real — not for show. - User-Generated Content (UGC)

Photos with your product, social media stories, honest reviews — these signals are stronger than any marketing slogan. Create the conditions for people to want to share their experience. - Brand Voice = Your Advantage

Tone, language, and style of communication are part of your competitive edge. If your brand sounds sincere and human — it’ll be remembered. - Micro-Influencers + Local Thought Leaders

You don’t always need to go after big names. Local bloggers and micro-influencers have deeper engagement with their audience. Work with those who truly earn trust in your niche or region — you’ll be surprised by the results.

Don’t chase every trend — pick the ones that work for your business. But whatever you do, don’t ignore change. Marketing that doesn’t evolve quickly becomes just another sunk cost.

4. Expand Your Service Line Strategically

Adding new products or services is one of the most effective ways to scale a business. If done at the right time and with market needs in mind, it brings several benefits:

- Attracting new clients — a broader offer opens doors to a new audience.

- Increasing the average check — existing clients buy more when they have options.

- Boosting loyalty — when your business grows alongside the client and offers them new value, it builds trust.

- Gaining a competitive edge — you stand out not just with price, but with a comprehensive approach.

- Diversifying risk — less reliance on a single revenue stream = greater stability.

But expansion only makes sense if it’s thoughtful.

Start with analysis: which needs remain unmet? Is there demand? What’s the potential margin?

Write out a strategy: who the service is for, how it fits into the business model, what team and resources it requires. Only then — move to implementation.

Strategic scaling is not about quantity of services but the quality of decisions behind them.

5. Money Doesn’t Like Guesswork — Implement Systematic Financial Management

A business can’t grow sustainably without transparent accounting. If you’re still making financial decisions by instinct or just checking your account balance — that’s not management, that’s guessing. And in the long run, it’s always risky.

Regular financial management helps identify weaknesses, avoid cash gaps, and make informed leadership decisions. Here’s how to start:

Step 1. Master the Basics of Managerial Accounting

Even if you have a bookkeeper or CFO, as a business owner you must understand the basics. This is crucial for strategic control:

- how managerial accounting is structured;

- what P&L, Cash Flow, and Balance Sheet are — and how to analyze them;

- how the cash method differs from accrual — and which is relevant for your business;

- how to plan expenses and revenue for the next month or quarter.

A common mistake is trying to manage finances manually in Excel. Formula errors, lack of a single responsible person, loss of data — all this leads to inaccuracies and losses.

Step 2. Automate Financial Processes

To save time, prevent errors, and get timely, accurate financial data — automate your accounting.

Finmap allows you to integrate bank accounts, so all incoming and outgoing transactions are synced automatically. But automation doesn’t stop there.

The next level is automatic processing rules (autorules):

The system analyzes transaction comments and categorizes them by project, counterparty, direction, and so on.

This in turn generates up-to-date reports automatically — available to you anytime, anywhere.

Finmap AI Copilot: Smart Financial Management Support

At the final link of this automation chain is Finmap AI Copilot — an AI tool that not only shows numbers but turns them into decisions.

Finmap AI Copilot automatically generates a detailed report based on your financial data. In it, you get:

- key metrics in a convenient format;

- warnings about potential risks: from reduced profitability to cash gap danger;

- personalized recommendations: how to optimize expenses, improve cash flow, or adjust your financial model.

It’s your personal financial analyst that never takes a day off — and works based on your actual business data, not assumptions.

Step 3. Plan, Don’t Just Record

Your account balance isn’t your profit — and without factoring in upcoming obligations, it can give a false sense of stability.

To see the full picture — financial planning is essential.

This is where Finmap’s Payment Calendar helps — a tool that shifts your finances from reaction mode to proactive management.

Thanks to the payment calendar, you’ll be able to:

- forecast upcoming expenses and income;

- anticipate cash gaps in advance;

- build reserves for critical costs;

- understand how much you can realistically invest or withdraw;

- plan profit based on data, not just gut feeling;

- finally stop living “from transaction to transaction.”

The calendar bridges the gap between current balances and future obligations — giving you real control over your finances.

Efficiency isn’t a one-time leap — it’s systematic work on yourself, your team, and your processes.

The 5 steps you’ve just read can change your business’s financial resilience. But to turn these changes into reality — you need a tool that lets you manage your finances without chaos.

Finmap is managerial accounting, automation, planning, and AI analytics — all in one solution.

Start now — take control of your finances. Because that’s where stability and growth begin.

Financial Model as the Key to a Million: How to Make Your Idea Successful

From idea to million: how a financial model can make it happen. Learn strategies that turn concepts into successful businesses.

Do you want to start a business or double your growth? You probably have a hundred questions swirling in your head: how much money do you really need? When will you break even? And will you even break even at all? What if everything goes wrong — how much will you lose?

If you don't want your idea to drown in chaos, it needs structure and a clear financial justification.

A successful launch and scaling aren't about intuition. They're about a financial model that, even before launch, tells you: “yes,” “no,” or “not now.” Want to know how exactly? Let’s dive in.

What Is a Financial Model?

A financial model is a working tool that helps you forecast your future financial results based on key operational, marketing, and financial indicators.

This model allows you not just to “calculate expenses,” but to see the full picture: from revenue sources to cash flow, from margin to break-even point. And most importantly — it enables you to make informed decisions before you spend a single dollar.

Your Profit Model: Key Components

A financial model covers all key business processes in terms of numbers. Here are the main components:

- Basic parameters

These are the data points the entire model is built on: prices, sales volumes, salaries, taxes, advertising costs, etc. If you change these numbers — the whole model changes.

- Revenue forecast

This block shows where the money should come from: number of clients, conversion rate, average check, repeat purchases, and how revenue changes over time.

- Operating expenses

A clear expense structure helps calculate cost price more accurately, identify reserves, and define the break-even point. The financial model takes into account:

- Fixed costs — do not change with increased or decreased volume (e.g. rent);

- Variable costs — depend on production or sales volume (e.g. packaging, delivery);

- Direct costs — directly linked to production or service delivery;

- Indirect costs — support the business indirectly (administrative costs, marketing).

- Investments and depreciation

If the business buys something “serious” (equipment, machinery, large projects), these expenses are recorded separately and depreciated gradually.

- Taxes

Calculation of tax obligations depending on the taxation model, profit, and type of activity.

- Cash flow

The real money coming into and going out of the business. Even if you’re profitable — it doesn’t mean there’s money in your account. This block shows whether there’s enough cash to cover everything needed.

- Balance sheet

Assets, debts, inventory, capital — everything the business owns at a given moment. It provides insight into the company’s financial stability.

- Profit and loss statement

Shows how much the company earned (or lost) over a period. This is the main report for evaluating performance.

- Financial indicators

Break-even point, EBITDA, margins, liquidity ratios — everything that helps assess business efficiency.

Together, this isn’t just a “spreadsheet of numbers,” but a model that allows you to test ideas, see the consequences of decisions, and confidently plan the future.

Real Reasons to Have a Financial Model Before You Launch

A financial model is not just a “file for investors.” It’s your working tool for strategic thinking and real control over your situation. Here’s what it gives you:

- Strategic vision

The model helps you see not only where you are now, but also where you're headed. It helps anticipate potential threats, identify growth points, and adjust your course before it’s too late. - Risk forecasting

With the model, you can evaluate multiple development scenarios: what happens if sales drop by 20%, whether there’s enough working capital during tough months, and how to respond to price changes. - Efficiency and optimization

The financial model helps identify where costs can be reduced, which areas offer the highest profitability, and how to allocate resources more effectively. - Competitive advantage

While competitors act blindly, you make decisions based on data. This gives you a tangible edge in speed, flexibility, and accuracy. - Connection between all processes

The financial model shows how every decision affects the business as a whole: how price changes affect revenue, revenue affects taxes, and taxes impact cash flow. It reveals interconnections that are hard to track intuitively.

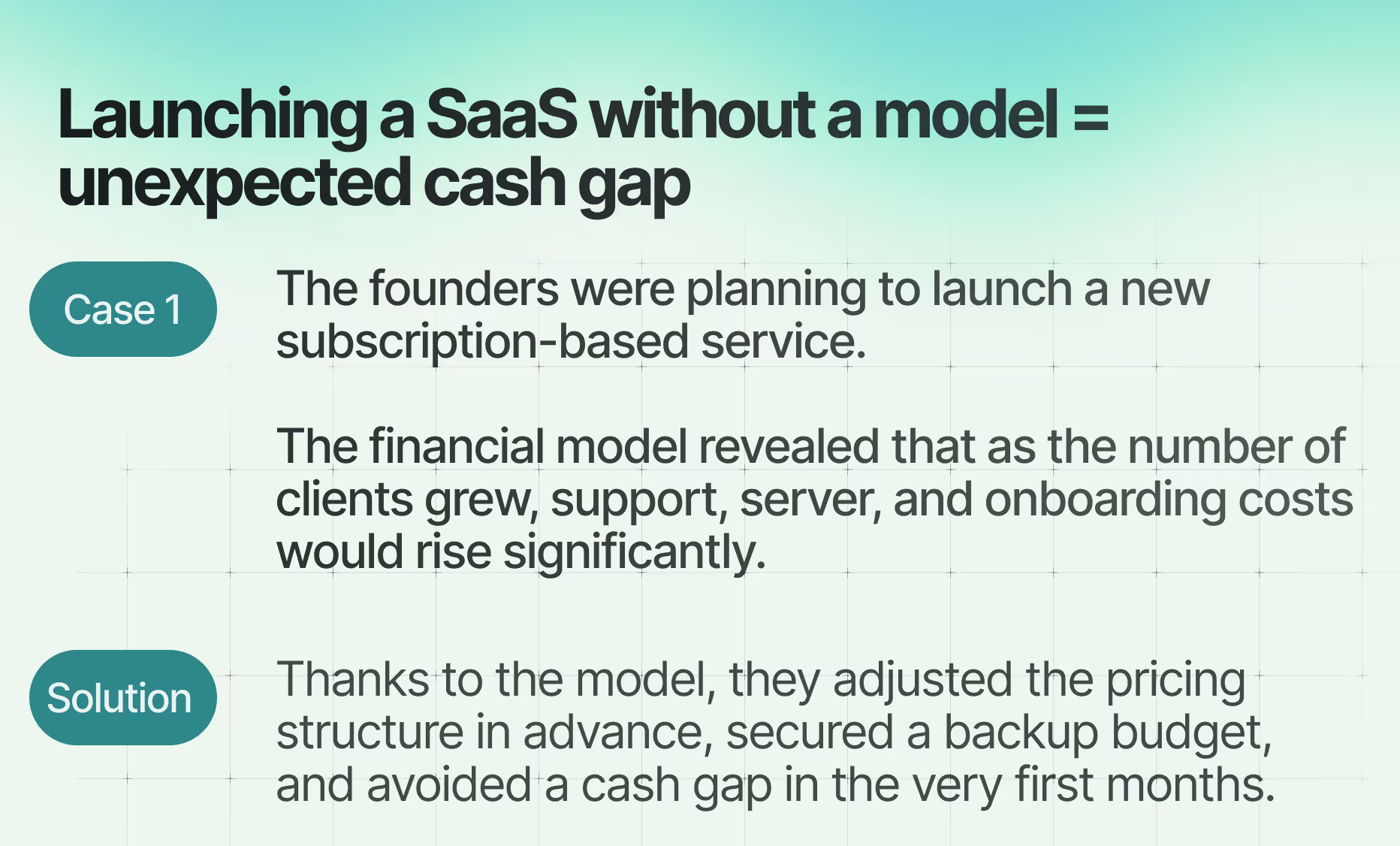

A Financial Model Isn’t Theory — It’s a Tool That Works in Practice

But how exactly does it help you make decisions, avoid mistakes, and plan a profitable launch?

To see it in action, it's worth looking at real examples. One such case is the EMMER company, which launched a new physical product to the U.S. market via Kickstarter.

It was a complex project involving international logistics, marketing, manufacturing, taxes, and influencer partnerships.

The financial model helped the entrepreneur:

- assess the realism of the fundraising goal;

- build several scenarios (optimistic, pessimistic, break-even);

- identify risks before the campaign even began;

- gather the data needed to make confident decisions.

Read the full Emmer case here → How Finmap creates financial models that ensure a successful launch

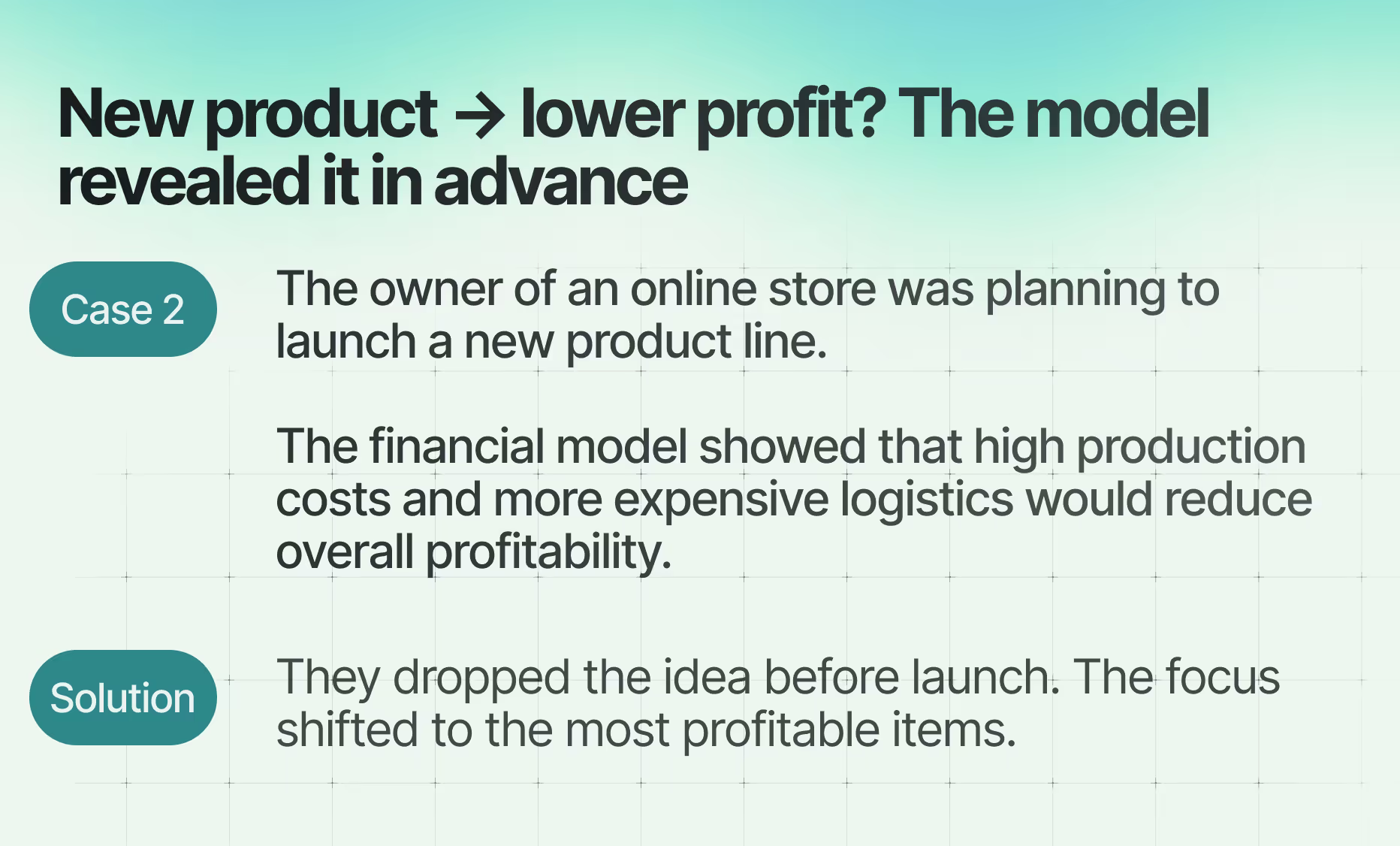

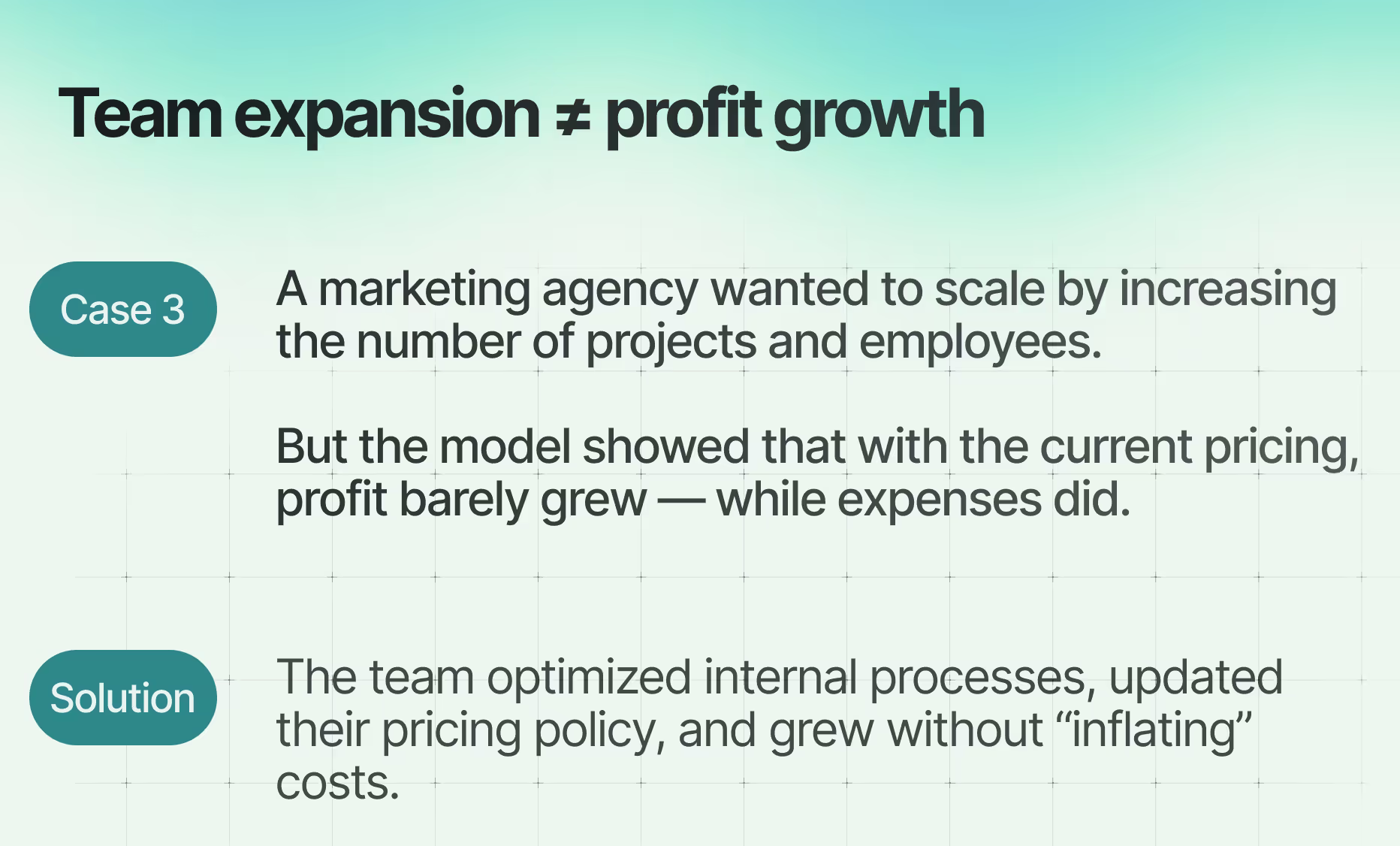

But this is just one scenario. A financial model allows for much more:

- Test hypotheses — for example, whether it makes sense to raise prices or launch additional services;

- Understand key impact points — which metrics affect profit the most and what actions truly make a difference;

- Avoid cash gaps — see when funds will fall short and adjust your plan in advance;

- Set realistic goals — instead of “I want a million,” understand how many clients and resources are truly needed to reach it;

- Calculate launch scenarios for a new direction or business — optimistic, realistic, and pessimistic, accounting for risks and resources;

- Determine if current resources are enough to achieve the goal — without relying solely on intuition;

- Accurately calculate how much you need to earn to recoup your investment — and whether it’s achievable at all;

- Evaluate whether your model allows you to earn as much as you want — before launching or scaling.

More real-life cases can be found in the carousel below.

Strong Model = Strong Decision

A financial model is not just a section in a business plan — it’s your key tool for growth, decision-making, and maintaining control over your finances.

It gives you not just forecasts, but confidence in where you’re heading — and what to do if things go off track.

But building a solid model is more than just filling out an Excel sheet. It requires expertise, realistic assumptions, and experience working with different scenarios.

That’s why at Finmap, we help entrepreneurs:

- build a financial model tailored to their actual business — not just a “template”;

- calculate key scenarios, including risks and the break-even point;

- identify bottlenecks and growth opportunities;

- create a clear picture for themselves, partners, or investors.

Book a consultation with a Finmap expert — and we’ll create a financial model that works for you, not just for reporting.

Start managing your business by the numbers — not by guesswork!

-1.avif)