How Finmap empowers businesses with multiple contractors to take full control of their finances

As a business grows, financial flows become more complex—and along with them grows the number of people and companies with whom you need to negotiate, coordinate, make payments, or await payment.

Everything looks orderly—until one delay, one missed invoice, or a mismatch in payment dates triggers a domino effect.

The true financial strength of a business lies not only in profitability, but also in the ability to forecast, analyze, and act in advance.

Let’s look at three key elements that enable a business to maintain stability and grow without chaos.

1. Systematic approach: the first step toward financial maturity in business

If your business works with dozens of counterparties—contractors, clients, partners, suppliers—finances quickly turn into a mosaic.

Invoices in messengers, acts in email, payments across different banks, and information about debts—in a notebook or in a manager’s head.

As a result, it becomes difficult to answer even the basic questions:

- Who owes whom?

- What payments are expected?

- How much money will actually remain after all obligations?

Without a single system, data gets lost, and decisions are made blindly. Even a profitable business can end up in a cash gap simply because of the lack of a complete picture.

Here’s what it looks like in practice:

- Scattered data — information about payments, debts, and income is spread across different sources.

- Invisible obligations — there is no clear date of when and to whom payments should be made or expected.

- Loss of control — income is coming in, but there’s still not enough money because of chaotic payouts.

- Decisions “by guesswork” — made without analytics, without a clear connection between contractors, clients, and projects.

Systematicity is when all financial data comes together in a single reliable system: you see incomes, expenses, and debts all in one place.

Assess the level of systematization in your business

If most of the answers are “no,” it’s a clear signal that your financial system is not yet functioning as a single whole.

True systematization means having your money, obligations, and analytics gathered in one place — not scattered across different documents and spreadsheets.

5 steps to systematization with Finmap

To stop your finances from being just a set of fragmented data, you need a clear structure.

Finmap provides tools that bring all processes into a single system—from recording payments to controlling balances and forecasting cash flow.

- Collect all accounts in one place. Add contractors, clients, and bank accounts to Finmap to see all income and expenses in one centralized view.

- Record every payment and obligation. Create transactions right after an agreement or receiving an invoice—so nothing gets lost between emails and chats. Use the mobile app when you’re away from the office.

- Connect banks and cards. Synchronize your financial sources so that balances update automatically, and reconciliations take minutes instead of hours.

- Tag counterparties and projects. Link every payment to a specific contractor or client—this provides a transparent history of settlements and profitability for each direction.

- Plan ahead. Use the payment calendar and cash flow forecast to understand when funds are needed and how to avoid cash gaps.

Note: once a business becomes systematic, chaos stops draining energy—and that energy turns into growth.

2. Predictability: from financial chaos to a manageable, foreseeable system

In a business with many clients, contractors, and suppliers, money is constantly in motion.

Some inflows are still pending, other invoices already need to be paid, and in between are dozens of small transactions that create financial noise.

Of course, you can operate without a forecast, but there will be no stability in such a mode: risks will keep increasing.

Why predictability is critically important for business

- Ensures liquidity control. Allows you to assess whether there are enough funds to meet obligations, when cash gaps may occur, and how to prevent them.

- Increases financial stability. A business with a forecast does not depend on random inflows—it prepares in advance for peak loads and seasonal fluctuations.

- Reduces risks and financial stress. When planned payments and receipts are known, management decisions are made with a cool head—without haste or panic.

- Improves relationships with partners, clients, and contractors. Timely payments build the reputation of a reliable company and strengthen trust in cooperation.

- Enables strategic growth planning. Predictability shows when it is safe to invest, expand the team, or launch new directions without the risk of cash shortages.

What distinguishes chaos from a controlled financial system

Finmap is a tool that enables businesses to forecast their financial results.

Forecasting is only possible when the system shows not just numbers, but the link between income, expenses, liabilities, and future cash flows.

Finmap is built precisely for this—to give a business a complete picture of its finances and make management predictable.

It combines management accounting tools that let you see not only what has already happened, but also what comes next.

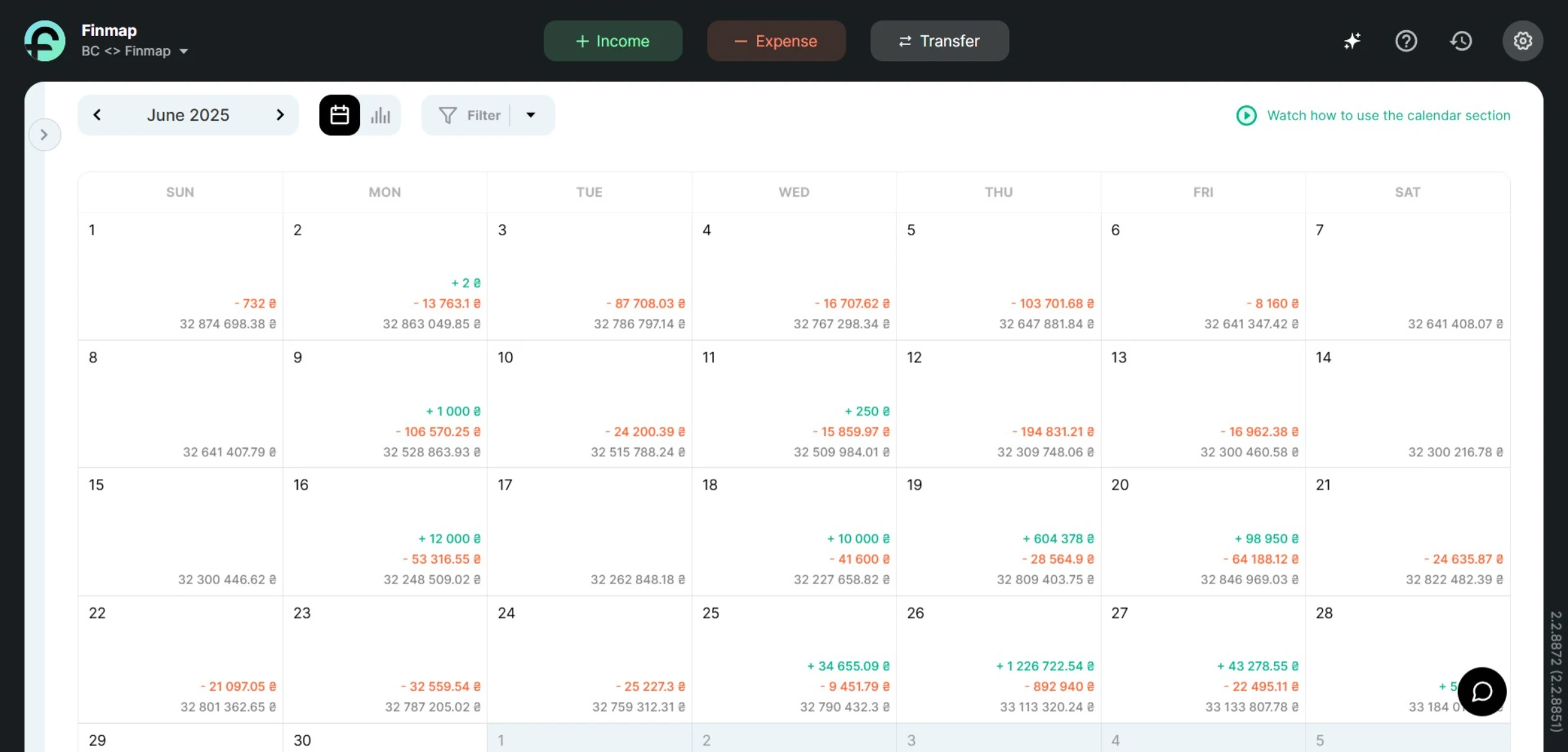

1. Planned payments and the Payment Calendar

In Finmap, you can plan both income and expenses, allowing you to record all future financial events before they occur.

All scheduled transactions automatically appear in the Payment Calendar, which builds a day-by-day forecast of your financial situation.

The more planned payments you enter, the more accurate the forecast becomes.

The calendar shows:

- which inflows and outflows are expected on a specific date;

- what the balance will be on the accounts after each transaction;

- whether there are enough funds on individual accounts for upcoming payments.

This tool helps identify cash gaps in advance and timely adjust financial flows.

A cash gap is not a sign of unprofitability; it’s an indicator of a lack of system in your finances.

The Payment Calendar in Finmap makes financial processes predictable and helps prevent situations where money suddenly falls short.

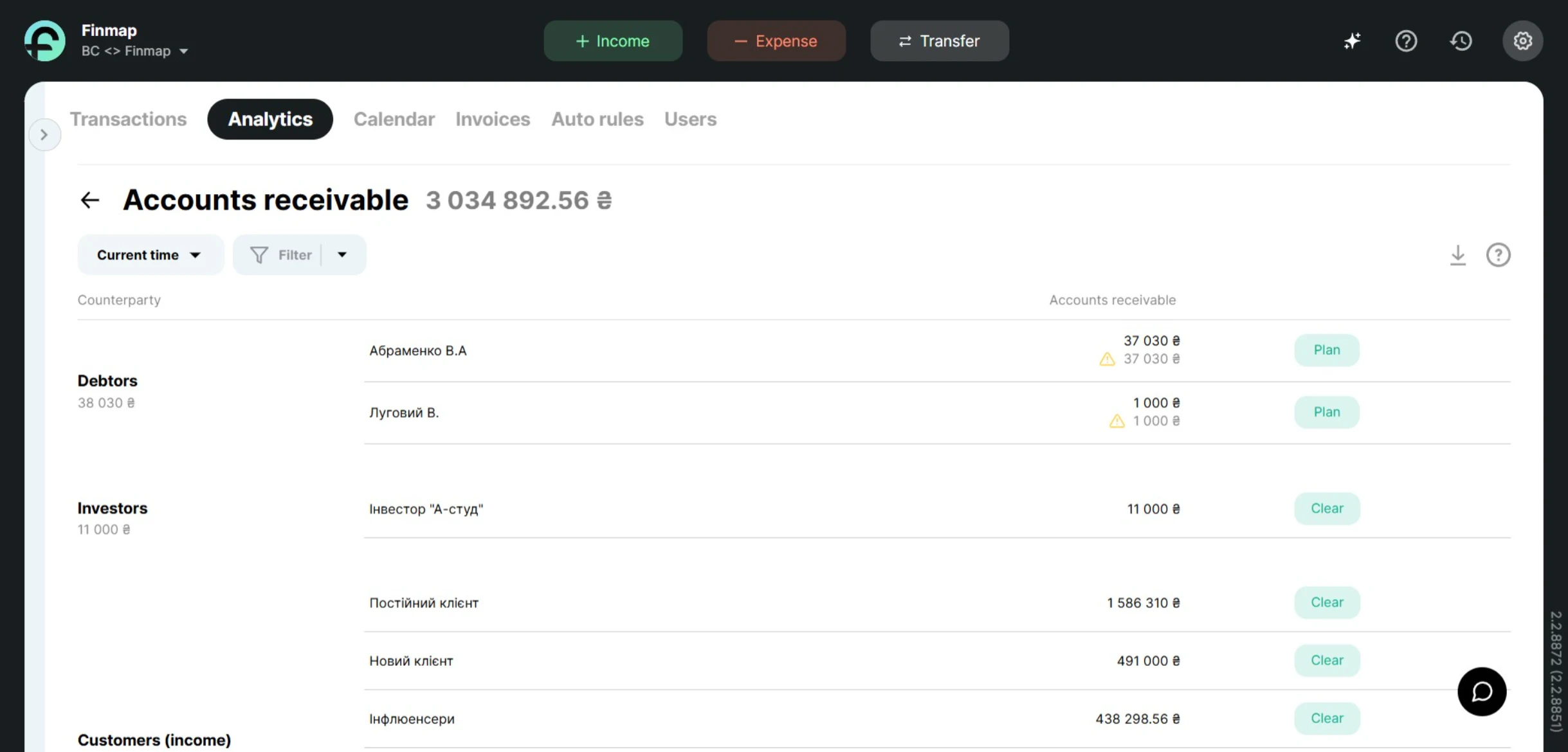

2. Accounts Receivable Report

The Accounts Receivable report in Finmap shows all funds that are due to the company from clients, partners, or contractors.

It’s not just a list of unpaid invoices, but a dynamic tool for controlling receivables that lets you see the financial situation in advance.

In Finmap you can see:

- who owes the company and how much;

- the expected payment date;

- the amount of overdue debts and their share of the total;

- the overall forecast of future inflows.

These data let you assess when exactly the company will receive money and whether it will be sufficient to meet current obligations.

With this report, you can timely remind clients about payments, avoid delays, and make more accurate cash flow forecasts.

“Accounts Receivable” is your control tool that ensures stability and predictability of inflows, turning financial chaos into a clear system of settlements.

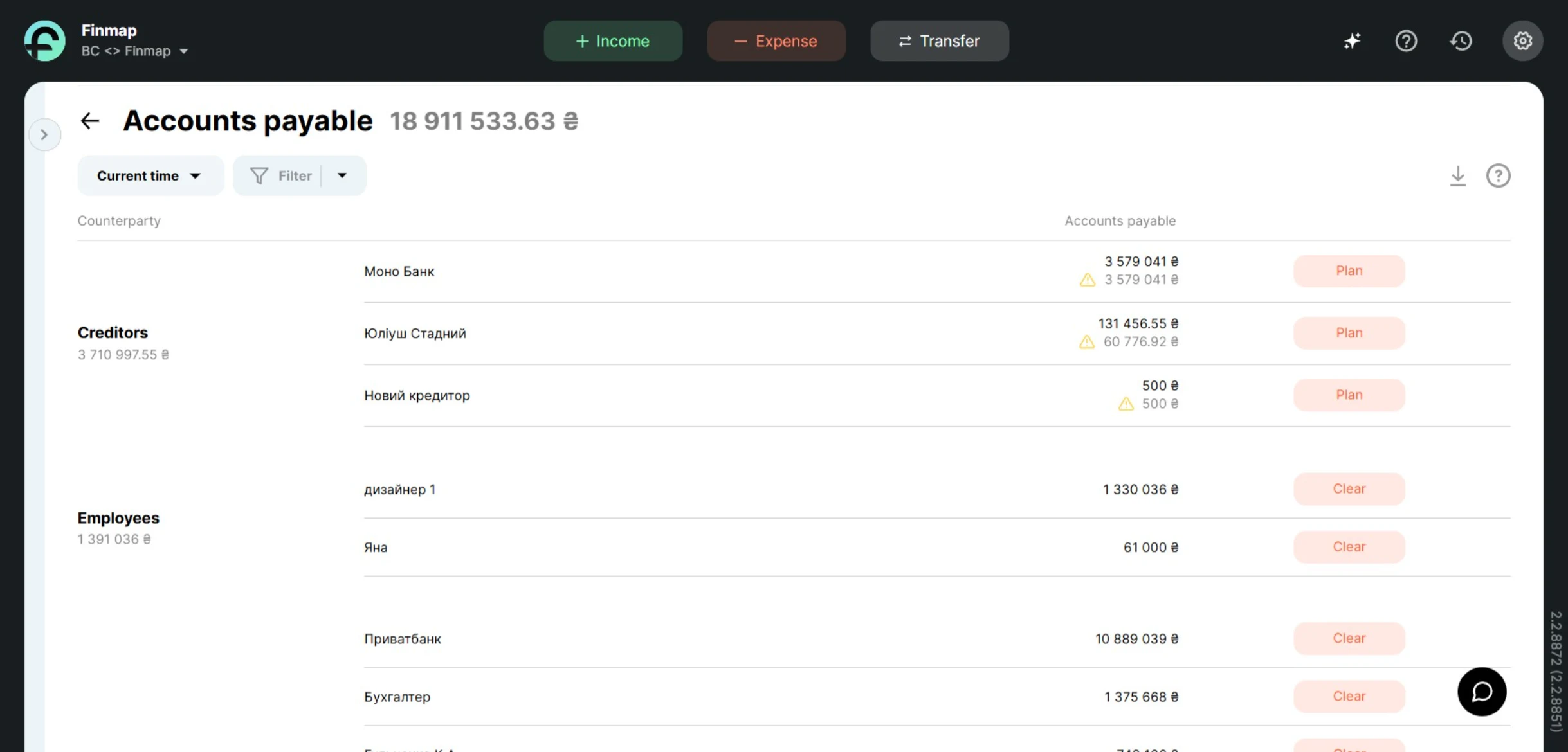

3. Accounts Payable Report

The Accounts Payable report in Finmap shows all the company’s obligations to contractors, suppliers, and partners.

It is a tool that lets you see to whom, when, and how much needs to be paid in order to avoid unexpected expenses and delays.

The report shows:

- a list of all upcoming and current payments;

- the dates on which payments are scheduled;

- the total amount of liabilities and their breakdown by counterparties;

- overdue payments that require attention.

Thanks to Accounts Payable, you can clearly control the company’s financial obligations, schedule payments on time, and ensure sufficient balances on accounts.

This helps avoid cash gaps, improves payment discipline, and builds the company’s reputation as a reliable partner.

The Accounts Payable report in Finmap is not just a list of debts but a financial forecasting tool that helps keep every hryvnia the company owes under control.

3. Analytics: when numbers turn into decisions

True financial management begins where analytics appears.

You can have systematization and even forecasting, but without an analytical view, a business doesn’t understand the main thing — why money comes in or disappears and what processes stand behind these changes.

Analytics is the ability to see not only the movement of money but also the meaning behind every number: which directions bring the most profit, which projects operate at a loss, which contractors or clients are the most efficient, and where expenses consistently exceed income.

Without analytics, financial accounting remains reactive — it only records facts. With analytics, it becomes a management tool that reveals connections, trends, and real results.

It is analytics that enables you to:

- measure business performance by numbers, not gut feeling;

- see the causes of financial fluctuations and respond in time;

- make strategic decisions based on data;

- optimize costs and increase profitability;

- plan growth using concrete metrics rather than intuition.

Finmap Reporting System: a complete picture of the company’s finances

Analytics in Finmap is not a separate tool but a system of reports that provide a full picture of the company’s financial state.

They show how different areas of the business operate and help evaluate profitability, efficiency, and the stability of financial processes.

Reports help you understand where the business earns and where it loses, and what decisions need to be made to improve the results.

For companies with many contractors, this is the key to effective management: every number has context, every payment has a reason, and every decision is based on data — not intuition.

How a business changes when finances are under control

Financial stability isn’t a coincidence—it’s the result of discipline, transparency, and understanding your own numbers.

Finmap helps shorten this path—turning data into confident decisions so the business grows without chaos.

Results of implementing a modern financial system

Finmap is not just a service, but a financial assistant that helps your business think systematically, plan ahead, and see real results in the numbers.

Take the next step — try Finmap and see how finances turn from a challenge into your advantage!

Frequently Asked Questions

1. How to understand that your business already lacks financial structure?

If reports don’t match reality, invoices get lost between channels, and there’s no clear answer to “how much money will remain after payments,” it’s a sign that your financial system operates chaotically.

2. Why can a profitable business still face cash gaps?

A cash gap doesn’t occur because of losses but because of timing mismatches between inflows and payments. The main cause is the lack of forecasting and obligation control.

3. How does financial forecasting help avoid risks?

Forecasting lets you see in advance when inflows and expenses are expected and prepare for periods of lower balances. This reduces the risk of delays and unexpected cash shortages.

4. Which reports should be analyzed to evaluate business performance?

The main ones are: cash flow (Cash Flow), profit and loss (P&L), debts, balance sheet, and plan–fact comparison. Together, they give a full picture of your financial state.

5. How to build a system that gives a real financial picture of your business?

Start with a single environment where all income, expenses, and obligations are recorded. Add regular report analysis and future payment planning — this will create the foundation for stability and predictability.